A Few Thoughts. A Few Charts.

Interest Rates, Cash, MARA and Uranium. Then we look at a couple of my largest trading positions. Let's goooo!

A Few Thoughts…

🟢 Interest Rates

US government spending has gotten out of control. I read recently that 55% of government spending now goes to unproductive areas such as Interest payments, Social Security and Healthcare. Imagine owning a business where the majority of the money you make goes to credit card payments, employee benefits and insurance. And your credit card bill keeps going up.

Interest payments as a share of federal revenue have doubled since 2021 and hit 17.9% in Q3 2024, the most since 1993. So imagine, in my scenario above, you make $100,000 per year and your credit card payment is $17,900! Wouldn’t you want your interest rates to be lower? I think the same is true for the US government.

The US government needs to keep lowering interest rates. They WANT to lower rates.

Go GOLD. Go HARD ASSETS. Go COMMODOTIES.

Just my thoughts.

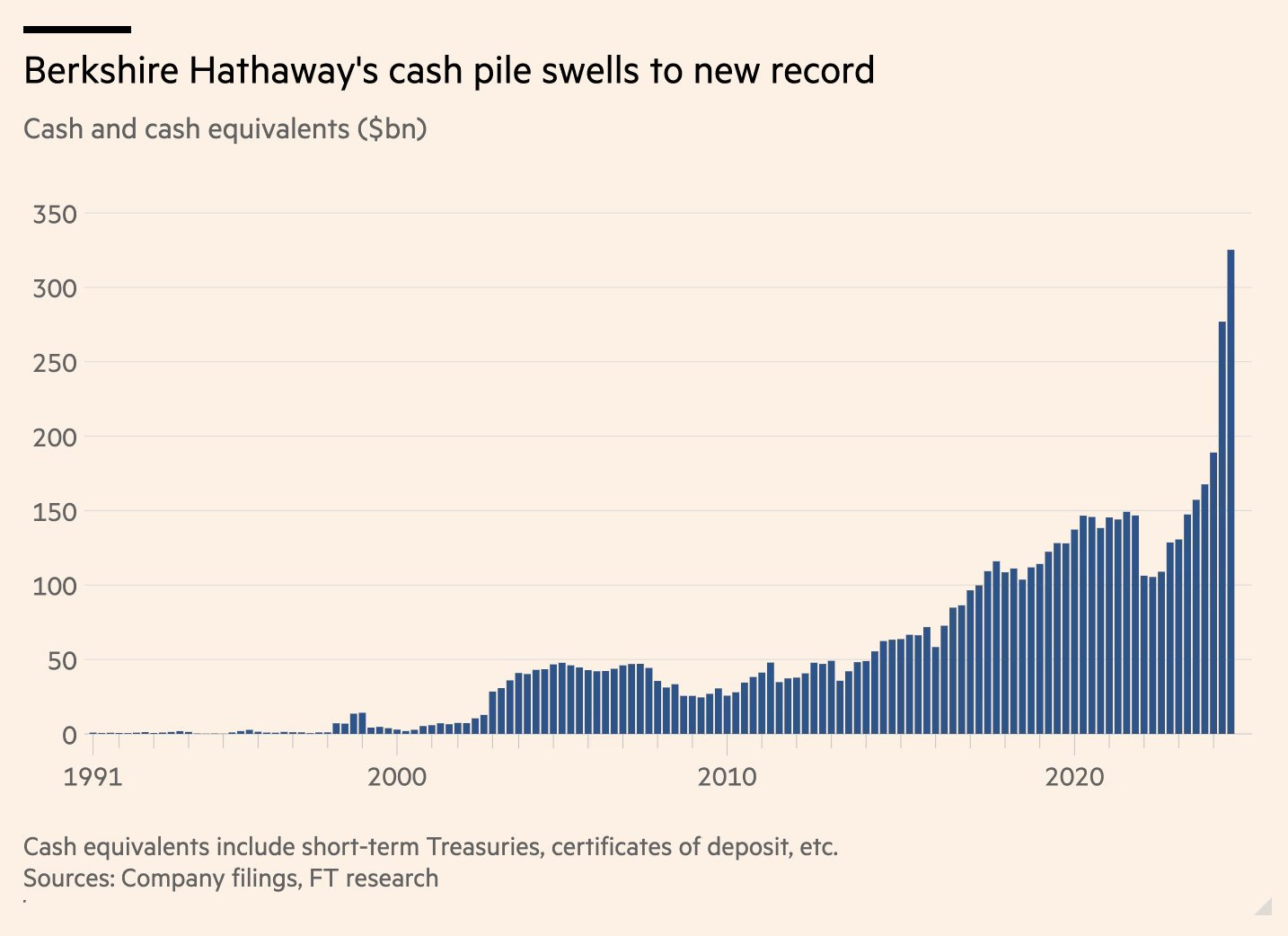

🟢 Buffett - Cash

Warren Buffet has been stockpiling cash in record amounts. It seems most of the smart money has been slowly exiting and raising cash for the next big “opportunity”. Do they know something we don’t? Or is this just smart money management?

This is not investment advice but for those FULLY invested with no cash on the sidelines, it might be something to think about. For me personally, I use a meaninful portion of my portfolio and roll large chunks into zero coupon bonds every month. I buy them at a discount and receive the full face amount a month later. Cash. Getting ‘paid to wait’ as I like to call it. It helps me sleep at night. This is only temporary, however. I’m primed and ready to take the opportunity if it hits. Market goes higher? Awesome. Market takes a dump? Sweet. Cash ready to deploy.

🟢 Bitcoin - Michael Saylor

I am neither a Michael Saylor fan, nor am I a follower of his, but I saw something on X recently that I thought made a lot of sense. It seems to have worked for him.

🟢 Uranium - Will it Hold?

I know I’m a chart guy, but I do still have my fundamental arguments for why something will go up or down. Uranium is one of those long term holds in my portfolio.

Sprott Physical Uranium Trust - SRUUF

Uranium’s supply/demand story tells me the price of uranium will be higher in the future. When? Sometime in the future. That’s all we know. In the meantime, the chart of SRUUF tells a story of similar indecision.

Will it bounce off blue support? And if it does, there is near term resistance shown on the upper rail of the green channel.

Or will it break down from blue support? If it does, my next target to the downside is the lower rail of support in green. Admittedly, it does look weak. But I’ve learned over the years not to PREDICT what it will do. I WAIT AND SEE what price does, then make my decision.

If price honors that blue trend line support, I enter the trade or add to my long term position. If it breaks support, I’ll wait to enter until further support.

Those are my thoughts for the week.

Now let’s look at some charts I’m watching.

Since Bitcoin has hit $80,000 over the weekend, let’s look at one of the Bitcoin miners, MARA. It closed Friday at $19.25, and I expect it to open big on Monday, up to resistance area at $21.50 range. A 10% spike. Seems to make the most sense. What it does when it gets there, I have no idea. I could slice through resistance and keep going or it could tap resistance, check back before marching higher. Either way, chart looks good.

👀 Let’s look at a couple more…

The next two are my biggest trading positions and they are playing out well!

Keep reading with a 7-day free trial

Subscribe to The Tobin Report to keep reading this post and get 7 days of free access to the full post archives.