Different Ways To Invest, a CNBC Segment on Uranium, and an Old Fashion

Sounds like the opening to a good joke!

In this week’s Tobin Report, I'll discuss:

Two different methods of investing 📈

CNBC and their take on uranium ✔

My favorite evening cocktail - The Old Fashion! 🥃

Normally I’m hilarious and full of amazing jokes, but in this report, I’ll try to stay on task in helping you become better with your money.

Here goes…

🎯 Two Investing Styles and How To Time the Market

➡ Method 1: Ignore market timing

➡ Method 2: Invest like a contrarian (this is actually my style) (I don’t know why I keep using parenthesis) (I hope I spelled that right!)

1️⃣ First Method: Ignore Market Timing

Most people cannot time the market. It is for this reason to just make consistent investments over time to build wealth. This should be done in a balanced portfolio that might be comprised of US based stocks, foreign stocks, and bonds. In full transparency, however, I do not own any bonds. As rates rise, bond values decline.

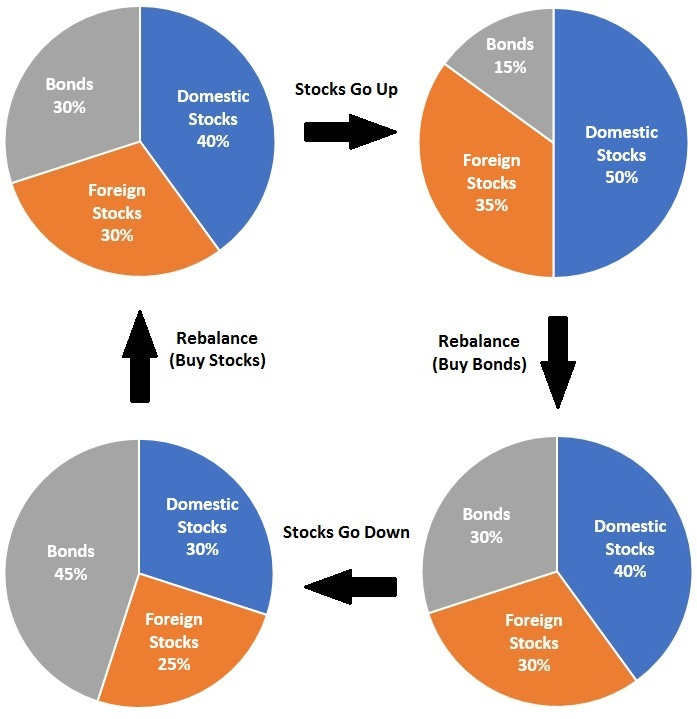

Let’s say you diversify with the following percentage allocations:

With this method, you would just make consistent investments into your baskets and over time, your wealth will grow. As time moves on, one segment will naturally outperform the other two segments. When this happens, you simply re-balance the portfolio to get back to baseline. For example, when stocks increase in value and take a larger portion of the pie, re-balance to increase the bond values. This should be done quarterly or semi-annually. No need to do this weekly! Simple. Easy. Brainless.

2️⃣ Second Method: Contrarian Approach

The second and more advanced method is to pay attention to valuation metrics of the market, and try to buy more stocks when stocks are cheap on a relative basis. Buy when nobody else is. When Tesla is up 600%, for example, it might be time to take profits and rotate that money into value. Maybe something cyclical that has flatlined over the years with potential to run in the coming years.

Specifically, cycle assets out of overvalued investments and into undervalued investments, which can include specific market sectors. This, for example, might mean selling technology and rotating into commodities. (HINT! HINT!)

Look at the chart below. This is a monthly chart of the Commodities Index relative to the S&P 500 over the last 17 years. This shows you how commodities have been a poor investment relative to the S&P 500 in the last decade. However…and this is extremely important…the chart also shows you that commodities have started to outperform the S&P. Commodities are cyclical.

This chart is one of many metrics I use to tell me where to put my money. I have been accumulating commodities which have been cheap relative to the high flying tech stocks this year. This is not over yet, by any means.

In fact, this chart is foreshadowing the next decade.

Being a contrarian investor is not easy for MOST people. Most investors ignore valuation and become filled with euphoria as the market keeps going higher. Then, when the market inevitably goes through a correction, they panic and sell when stocks have fallen in price, locking in their losses.

The rational approach is to do the opposite; be a value investor and become excited after market prices have dropped and stocks are cheap, and become cautious when stocks are historically expensive.

So there you have it…two different methods for investing. Your personality, time horizon, and risk tolerance, are factors that dictate which of these methods is right for you.

🎯URANIUM

It seems CNBC has been reading The Tobin Report too!

👇👇👇👇👇

📣Shouting

I have been shouting from the mountain tops about uranium the last 18 months. Hopefully some of you have been buying when it was difficult to do so. As I wrote above, being a contrarian is not easy because it requires you to buy what many are selling. It requires patience and a stomach for volatility.

CNBC recently aired a segment on uranium. Watch it here. Much of what I invest in does not typically hit mainstream media because I am a contrarian. Uranium fits this mold. As this contrarian investment starts to pay off, it will begin to surface in mainstream media.

This is just the beginning.

In the coming years, your mailman and bartender will be telling you all about uranium.

That’s when I plan to sell. But we still have a long way to go.

That said…don’t chase. Wait for the next pullback. There will be many.

🎯My Favorite Old Fashion Recipe 🥃

I’ll finish with this…

For those of you who know me, you know my favorite evening cocktail is the old fashion. It’s my “unwind”.

As Frank The Tank so famously said,

“It tastes so good when it touches my lips!” (this just got a little awkward)

And if you don’t know who Frank The Tank is, then I don’t think we can be friends anymore.

🥃 2 ounces of bourbon, or rye whiskey (Knob Creek or Woodford Reserve are perfect)

🥃 1/2 ounces of simple syrup - to “smoke” it up, use Tippleman’s Barrell Smoked Maple Syrup

🥃 3-4 dashes of bitters: my favorite is rhubarb bitters or spiced cherry

Mix the ingredients into your rocks glass, give it a stir and add your large cube. Lastly, garnish with an orange peel…express the oils into the drink, rim the glass and toss it in.

You are now ready to watch baseball. ⚾️

That’s all for the week. Thanks for reading.

Eric.

If you like the content of what I put out, please share with someone so they can share with someone and so on. Why? Mostly because I said so. Just do it. 💥

Every investor should read this! (Twice) (maybe 3 times)

Also, Frank The Tank! Frank The Tank! Frank The Tank!