GOLD

Last week Jerome Powell stated he would be raising rates again in the coming months and that there would be no rate easing in the rest of 2023.

The TD Bank’s Head Commodity Strategist said the following in direct contrast afterwards:

We suspect that data and inflation will weaken in the not too distant future, with the Fed likely lowering rates before hitting its inflation target.

As such, we expect gold to do quite well in the months ahead.

Regardless of another hike or not, we are near the end. This is when gold shines. In fact, gold has held on strong in the face of all sorts of headwinds this year!

TD Bank continued their analysis by saying:

The Fed will ease in 2023 (gold tailwind)

They will ease *before* they get to their 2% inflation target (gold tailwind)

Gold will “do quite well”

Gold is setting up for an explosive breakout. As we know, the gold market is manipulated so another flush to the downside is possible. But as global demand by central banks continues to increase, I suspect we will start to see manipulation to the UPSIDE once we decisively break above $2000 / oz.

Agnico Eagle (AEM)

One of the largest gold producers - making higher lows and higher highs.

LABOR MARKET

The labor market is a lagging indicator of recession. Looks like we are starting to see the lag as jobless claims SPIKED this last week. Was it a one-off? No sure but we’ll find out.

Remember, the Fed WANTS you to lose your job. They NEED you to lose your job.

Sad, but true.

The Fed knew these numbers just before their rate hike (or pause) decision on Wednesday.

The last time we saw jobless claims spike (not counting the Covid bullshit) was just before the Great Financial Crisis.

I’m not saying that’s where we are headed…just pointing out facts.

RETAIL SALES

No bueno. That’s Spanish for RECESSION. Actually, it’s not. But retail sales numbers are weak.

Retail sales are not adjusted for inflation, so the take-home net of consumer spending is now seriously negative.

Things are not as good as US economic cheerleaders would have us believe.

Trade Idea

Southwestern Energy (SWN)

Southwestern Energy engages in the exploration, development, and production of natural gas and oil, including operations in Pennsylvania and West Virginia. The company was founded on July 2, 1929 and is headquartered in Spring, TX.

Market Capitalization: $6.1B

Earnings Per Share: $5.85

Price to Earnings Ratio: .94 (yes, less than 1!)

They are not only cash flow positive but their share price is equal to what they are earning!! P/E ratio is essentially 1.

Compare this to NVDA who has a P/E of 221!!!! NVDA has more risk to the downside than SWN, obviously.

This is what I call a value play.

This is a BUY in my opinion. I own SWN.

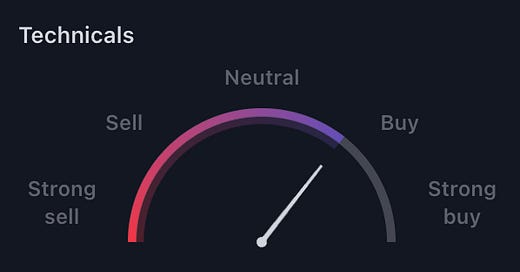

Technicals on SWN

First, you know how I feel about commodities. I’m bullish.

This chart of Southwestern Energy is a classic bearish to bullish reversal.

Clear downtrend ✅

Basing pattern / selling subsides ✅

Reversal from downtrend to uptrend ✅

In my opinion this is a buy now. Any further dips should be bought.

That’s all for now.

Eric

Nice analysis Eric!