GOLD

Let’s talk briefly about gold. If you’ve held physical gold, you did quite well in this rate hiking, inflationary environment. While the overall stock market was down…gold was not. The purchasing power of the dollar bought you much less than before. That is obvious.

So when does gold really do well?

Let’s start by answering this by addressing the inverse. When does gold NOT do well?

Gold does not like rising interest rates environments. If you told me a year and a half ago that the Fed would raise rates from 0% to 5% today (like they did), I would tell you gold would have dropped MASSIVELY.

It didn’t.

In fact, gold is only 11% off it’s all time high….and rates have gone from 0% - 5%. Incredible. One could argue, the last 18 months were the WORST conditions for gold to thrive. And yet it’s only 11% off its ATH.

Now, to be honest, I never would have thought the Fed would raise that aggressively. Higher rates means higher interest payments on the government debt…and there is a LOT of debt. (stating the obvious)

So will the Fed continue raising rates? How high will they go?

I don’t know, obviously…but I think it’s fair to say the Fed is NOT going to do another 5%, bringing the Fed Funds to 10%. That would CRUSH everything.

Sooooooo….I think it’s safe to say we are closer the the end of rate hikes than the beginning.

Let me then paint a picture moving forward for why I think gold will sky rocket.

Painting A Picture…

🟢 Inflation dropped from 9% to 5%. Yay Fed. But they want 2%.

Note: Dropping inflation from 9% to 5% is much easier than from 5% to 2%…which is impossible without the unemployment rate getting to 10%. We are in the mid 3% now.

So, either unemployment DOES go to 10% (holy shit!), thus reducing inflation to 2%

or it doesn’t…which means inflation stays at 5% (holy shit!)

THE FED KNOWS THIS

🟢 This means we have higher inflation IMBEDDED…NOT transitory.

🟢 So the Fed keeps raising rates. Something NEEDS to break.

🟢 We enter a recession.

🟢 Recession leads to earnings drop...markets guide lower.

🟢 Fear sets in. People are afraid to fully invest in the market as the stock market is less attractive.

🟢 People realize we are in an inflationary environment…for a LOOOONG time.

🟢 Fed can’t raise more rates, especially into a recession with unemployment rising.

🟢 Inflation stays high.

🔴 At the point we are in a recession…unemployment is rising…inflation is not getting to 2%…and something breaks…the Fed will likely intervene…thus, reducing rates IN AN INFLATIONARY ENVIRONMENT.

👉👉👉 Gold to new, all time highs.

Kinda like in the 1970s…

Which leads me to the charts

(If you guessed they were gold charts, you’d be right)

2 charts…

Present day

1970s

Two inflationary environments.

1️⃣ First:

Weekly chart of gold. Present day.

2 years up.

2 years of consolidation.

No crash, just consolidation within a range for two years. One could say gold was “digesting” the gains after doubling in price.

2️⃣ Second:

Weekly chart of gold. Old school. 1970s.

2 years up.

2 years of consolidation.

No crash, just consolidation within a range for two years. One could say gold was “digesting” the gains after quadrupling in price.

Sound familiar?

So what happened next?

👇👇👇👇👇

None of this happens overnight. Be patient. Let the fundamentals play out. Block out the daily noise of price action when it comes to your longer term thesis.

⭕ And if you disagree with the above picture I painted, you may not want to hold gold.

⭕ If you believe the US will pay down its debt, reduce spending, clean up its balance sheet, stop printing money, make good with China and Russia…then you may not want to hold gold.

⭕ If you believe the purchasing power of your US dollar will buy you more, not less, moving forward, you may not want to hold gold.

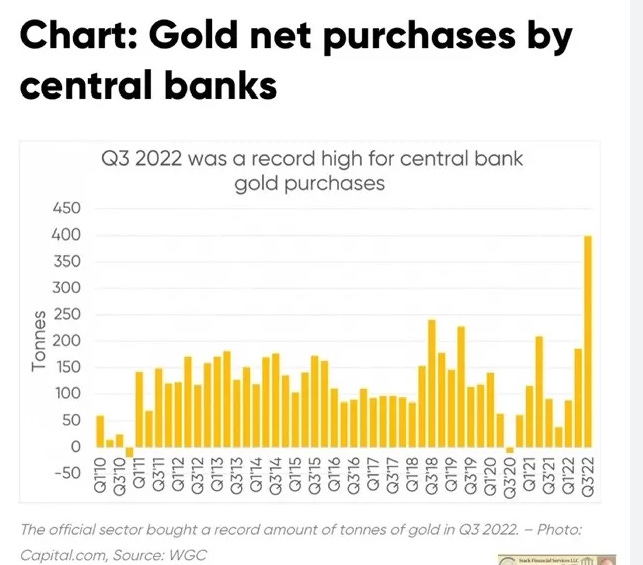

⭕ If you believe Central Banks have been buying gold in record amounts because they have no idea what is coming, you may not want to hold gold.

Central banks and country leaders KNOW what is coming. They do not want YOU and ME to know what is coming. It’s time to pay attention to what they DO, not what they SAY.

That’s all for today. Hope this was helpful in some way.

Eric

🍻PS - I’d love for you to share The Tobin Report with ONE person today. Not TWO…just one. ☺

And if this is your first time here, please consider a free subscription.

Very informative article! Thank you!