Let’s talk about uranium.

Uranium is used as fuel in nuclear reactors, mostly for electricity generation. Yellowcake, or U3O8 as it’s known chemically, is a uranium concentrate powder used in the intermediate step of the nuclear fuel production. Again…electricity generation.

It is also one of the cleanest and most reliable form of electricity generation. Clean and reliable energy…sound familiar? That’s because we are in a global energy crisis and it takes up much of the news headlines.

Nuclear energy is a HUGE solution to this crisis. Without it…the lights would literally go out.

My thesis is that the uranium bull market is just getting started.

In fact, I’d compare it to the 2nd inning of a baseball game (Go Dodgers!). Yes, U308 stocks have taken a hit in price lately, but just about everything has. Uranium mining stocks are still stocks. They are susceptible to human emotions. When people panic sell…or get margin calls…everything gets sold. This just creates more opportunity on a boat many people thought they missed.

Well now is your chance to get back on!

If you believe in the uranium thesis like I do, then the recent discount in price is a gift. Many will look back at today’s prices and kick themselves for not getting in.

I will not be one of those.

Understand, however, that the price of a given company does not always correlate to the VALUE of the company. Example: fundamentals of uranium continue to increase (SIGNIFICANTLY), however, price goes lower. Hmmm. Why does this occur? It’s called arbitrage. Price is not lower because uranium is no longer needed or because there is an oversupply of uranium, for example. Price is lower because people are freaking out about overall monetary policy and fed tightening. I am seeing the same panic and fear we saw in March of 2020…and the selloff in the GFC of 2008…and 2001…and several others. Those were great opportunities if you knew where to look and had the wherewithal deploy cash.

“Be greedy (BUY) when others are fearful. Be fearful (SELL) when others are greedy.” - Warren Buffett

Now is the time to be greedy. I’ve been accumulating shares on days when the market has been free falling. This is not investment advice, however. Make sure you are doing your own research.

Will uranium stocks go lower? Maybe. Probably. Will I know when the bottom is in? Nope. But when U stocks rip…they rip your face off. You don’t want to get caught chasing these stocks. Below is one of many examples of the volatility in the uranium space.

One of my favorites, Paladin Energy, currently sitting at $1.6B market cap, moved from $0.41 to $1.12 in just 19 trading days! This was back in September of last year. It has since corrected and given you a gift.

Merry Christmas. Happy Birthday. Happy Father’s Day (my personal favorite).

Investment Thesis For Uranium

So why do I like uranium for my portfolio?

#1 on my list is: Supply vs demand. This is economics 101.

Long story short, we need more than we have. This is a global issue. In the chart below you’ll see the amount produced (white bars) is drifting lower. The amount required is sloping up (white line). That gap between what is needed and what is produced will inevitably cause the price of uranium to go up, thus incentivizing producers to find more.

Nuclear fuel consultants estimate the global demand to be roughly 200M lbs vs the 135M lbs of mined supply. That’s a global supply DEFICIT of roughly 65M lbs. Secondary supply which has been used in prior years to fill this gap has been drawn down.

The emergence of the new FAANG and the drive to decarbonize.

The original FAANG was an acronym made up of tech leaders that enjoyed growth over the last decade as the economy increasingly digitized. FAANG 2.0 is gaining recognition and reflects the new world of resources and REAL assets in a value driven rotation I believe is happening now.

FAANG - Fuels, Aerospace, Agriculture, NUCLEAR, Gol

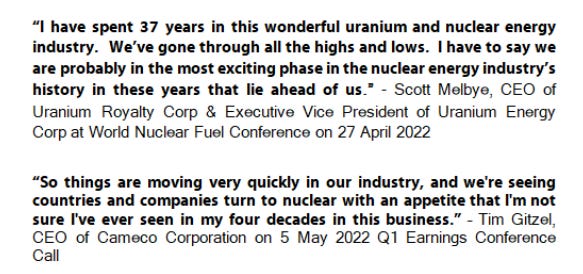

Uranium is a cyclical commodity and has been beat up by the global market since the Fukishima meltdown in 2011. However, there has been a sudden wave of new demand by MANY countries to achieve net zero emissions. In the prior decade, many countries had planned nuclear phase-outs but we are just now seeing those phase-outs being dramatically reversed.

Countries like North Korea, Japan, and even the UNITED STATES are accelerating restarts of reactors. This is BULLISH for nuclear investments. In fact, the fundamentals have NEVER been so bullish.

The weekly chart of URA, Global Uranium ETF going back to 2011 shows the price action reversing trend. The 200 weekly moving average (yellow upsloping line) is starting to curl upward.

2011 saw the uranium dip into a severe bear market (Fukishima disaster) until 2015

2015 - December 2020 was dull and boring and a time to accumulate. That’s when smart money gets in. Early.

2020 - we entered a new bull market in uranium that is predicted to last into the next decade. You can see it in the charts. It’s as if the chart is talking to me (once again, lol). This is another time to enter as we can see confirmation. Albeit at higher prices, but still before mainstream gets in.

I could go on about all the many reasons why I like uranium. Both fundamentals AND technicals are aligned for the next leg up in uranium mining companies.

I’ll be writing more about uranium in the weeks to come as this is my #1 holding. I hold ownership in 10 different uranium equities over multiple jurisdictions. Producers, developers and a couple explorers.

My point is this:

Find what you like. Know why you like it and sit tight. Don’t panic. Time will be your friend.

If you liked this, I would appreciate you sharing this with someone as this supports the work I do.

Thanks for reading,

Eric