Gold Miners List | Mental Health | Newsletter Recommendations | Swing Trading Alert

This week I cover a bit more, including some Substack newsletters I recommend, a list of ETFs and gold stocks, chart pattern of the week on Intel, and a bit more.

Hey everybody. Thanks for reading. Let’s get to work…

👉 In this week’s report, I cover a bit more information than I usually do. I recently read something on mental health that resonated with me so I wanted to share that article with you all. It’s obviously not money or chart related but equally important in overall wellness.

👉 In addition, as the gold market heats up, I’ve been getting more requests about the different investment vehicles one can use to both profit in this gold bull market as well as protect against the erosion of the US Dollar.

With that said, let’s get started…

In this report, I’ll cover:

🥇 Gold ETFs + Gold Producers + Physical Gold

✅ Quick Poll

🎯 Mental health tips + strategies from

📰 3 Newsletters I recommend

📈 FREE trading service - receive swing trade alerts 👇

📊 Chart pattern of the week - I’m a buyer here

1️⃣ GOLD

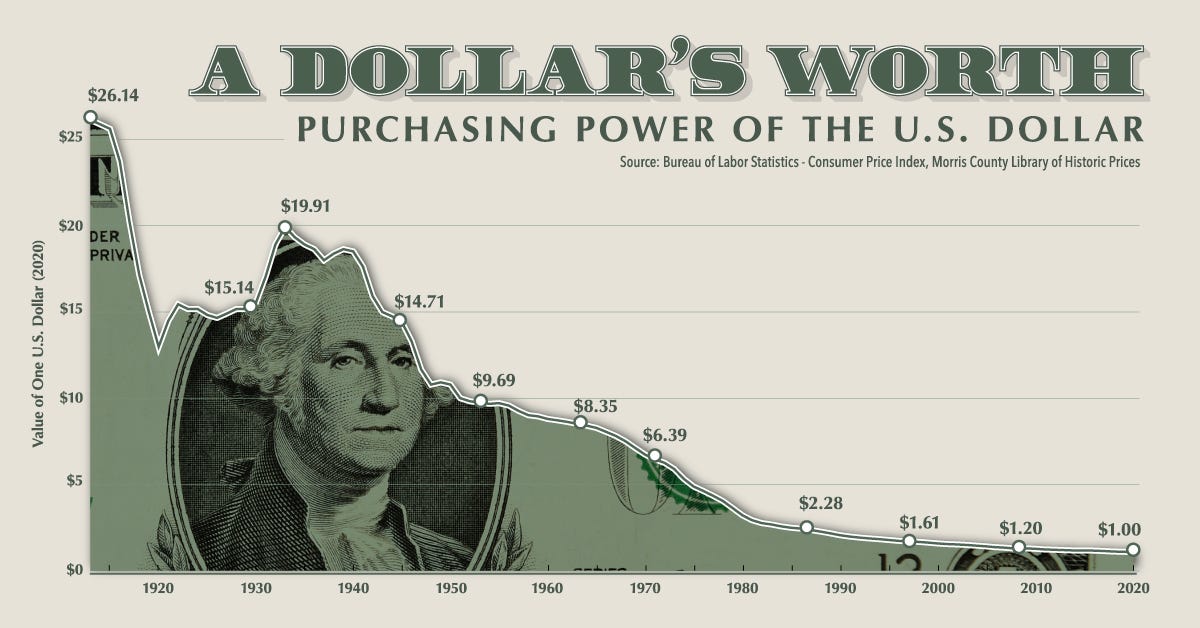

✔ Fact: we are in a precious metals bull market. ✔ Fact: gold is tapping the door to all time highs. ✔ Fact: the US dollar continues to devalue and much of the world is reducing exposure to it.

As the dollar erodes, 1️⃣ how can you protect your wealth? And, 2️⃣ How can you PROFIT from the current bull market in precious metals, specifically gold and silver?

Most investors have not been in this space before and are now getting on board with the idea that gold is actually THE reserve currency of the WORLD and a pretty secure place to store your wealth.

📩 A recent email I received…

“Eric. I self-manage my deferred money in TD Ameritrade. What should I put it in to get into the gold market? I usually just buy stocks in companies I use, I like, etc. A lot of my money is in an ETF that tracks the overall market for the long game. But do you have any gold ETFs that you buy? Thanks.”

Great question. There are various ways one can participate in the precious metals sector. Gold ETFs. Physical gold. Individual gold companies that discover and produce gold. Individual companies LOOKING for gold (HIGHLY speculative).

But to answer that question, specifically: I personally do not invest in gold ETFs.

Why not?

I conduct so much research and due diligence that I create my own basket of companies. I invest in the highest quality junior mining companies with the best projects, best balance sheets, safest jurisdictions and the best management.

That said, if I did not conduct the HOURS and HOURS of research that I do, I would absolutely invest in the gold ETFs in this space.

I would also be comfortable investing in the largest gold producing companies that have been around a long time.

I’ve put together a PDF file of a few ideas to help you out. ETFs. Mid-tier producers. Gold and silver. This one is free. 😎

🥇 Gold Miners PDF is below… 👇

Understand, however, there is risk in mining. I own MANY companies in MANY parts of the world to spread my jurisdictional risk. If you are new to this space, you might want to do some research on this topic.

🎯 Another way to safeguard your wealth against the erosion of the US dollar is to buy physical gold. Yes, I said PHYSICAL gold. Why physical? Because it’s YOURS. Nobody else holds it. No bank. No institution. No government. No third party……………….just you.

For those of you that trust the government, trust the banking institutions and just want the exposure to physical gold but don’t want to actually hold it, you can invest in something like PHYS, which is the Sprott Physical Gold Trust. This is publicly traded through your broker. Each share purchased represents ownership in physical gold bullion…actual physical gold.

Sprott Physical Gold Trust operates as a closed-end investment trust, which engages in investing and holding all of its assets in physical gold bullion. Its investment objective is to provide a secure, convenient, and exchange-traded investment alternative for investors through investing primarily in long-term holdings of unencumbered, fully allocated, physical gold bullion and will not speculate with regard to short-term changes in gold prices.

I’ll finish the gold segment with this…

✔ Physical gold protects your purchasing power and is not meant to make you rich.

✔ Gold ETFs are the safest way to play this sector but will give you the safest returns. (maybe 1.5x-2x, depending on where we are in the cycle)

✔ Individual major & mid-tier gold producers will give you much more upside potential…but carry more risk than an ETF (2x - 5x upside, depending on the cycle and specific company)

✔ Individual junior gold miners are where the 3x-10x returns are…but understand there are significant risks involved speculating in this space. THIS is where much of my research is in this junior gold mining space.

☘️ For those looking for significant upside potential, the individual, small cap, junior miners with gold in the ground and developing mines are the place to speculate for the biggest gains.

Paid subscribers will begin receiving my portfolio of junior miners. 😎

2️⃣ Quick Poll:

3️⃣ Mental Health Tips

Recent article I read that I found extremely helpful as it relates to mental health. It’s a 3 minute read and I definitely recommend this to everyone.

4️⃣ 📝 Newsletters I Recommend

👉 Here are 3 newsletters I’m currently recommending that I strongly suggest you check out:

1️⃣

- Research on commodities market - oil, Nat Gas, Au, Ag, BTC.2️⃣

- Investing 💰📈3️⃣

- Swing trading5️⃣ Swing Trades - Receive Alerts

I am beta testing a swing trade alert service for those interested in receiving my real-time trade alerts via text message. This includes all BUY and SELL alerts for MY PERSONAL swing trades. These are trades I hold for several days to several weeks.

You can either click here to quick register or you can text the word TRADE to (844) 949-3002.

I recently put out a REAL TIME buy alert here in The Tobin Report (shown below👇) in oil…(UCO)

Just closed it at $29.12 for a 37% gain.

Here was the alert…

6️⃣ Chart Pattern of the Week

INTC - Intel Corporation

Beat up. Recovering. Bottoming formation, double bottom. Breakout of range…now retesting breakout.

I’m a buyer here.

🎯 Please Subscribe & Share

✔ Subscribe | I provide FREE content on a regular basis to all my subscribers. Please consider subscribing if you are not already.

✔ Share | If you enjoy reading The Tobin Report, I ask that you share with someone you think might enjoy reading it as well.

Thank you sincerely for being a subscriber and supporting my work,

Eric

Love the mental health and gold etf suggestions. Sad our purchasing power is eroding. Just signed up for you your beta trade alerting service. I’m always looking for ideas!

Thanks Eric for the recommendation. Much appreciated!