Personal Finance - Growing Your Wealth 💲

In part 1 of 4, we look at first assessing your overall finances

Hello everybody!

Welcome to issue #15 of The Tobin Report! I really do appreciate everyone who reads these. Thank you.

As promised, I am doing a 4 part series on personal finance. The outline was in last week’s report here. The goal is to help educate others on and raise awareness to good money management skills.

This week is Part 1:

I am writing this series in the scenario as if someone came to me asking for help. This person might say something like this:

“Hey Eric, I am looking for some help with my finances. I make pretty good money but for some reason I am not as organized as I could be. I’m not sure where all my money goes but I need to do a better job planning for my future. Can you help me?”

In this situation, my approach would look like this:

Assess their current financial situation, including how they view money and its role in securing their future. Is money a tool to buy cool things or is it a tool to give you more time later in life? This process also includes determining their net worth by creating a net worth spreadsheet. This is their starting point.

Next, we would review all income sources: Primary income, spousal income, side hustle, overtime, investment or rental income, dividend income, etc. How much money is coming in and can we increase this?

Identify and analyze ALL expenses then divide them into categories: fixed expenses such as a mortgage or car payment VS variable expenses such as gas and food. Within these we can look at discretionary vs non discretionary, i.e. things you don’t need vs things you do need.

DEBT - outside of their mortgage, how much do they owe and at what percentage? From here, we can prioritize and forecast.

Let me know your thoughts on this so far…

Once steps 1-4 are complete, we now have an understanding on where they stand.

Positive cash flow or negative cash flow? Is there anything left over at the end of the day?

If not…something needs to give.

If so…where is that cash going?

If you’re in the negative cash flow category (i.e. paycheck to paycheck), don’t be embarrassed. I think more people are struggling with their personal finances than they let on. We are in a highly inflationary environment where many people’s retirement and savings have been slashed in recent months.

Let’s fix this.

If you’re in the positive cash flow category, are you growing this money? Are you aware of the various investments strategies that exist to diversify your portfolio?

That’s Part 3 of this series.

Calculate Your Net Worth

What is it? How do you calculate it? Why do I need it?

Your net worth is essentially the value of all your assets minus what you owe. It’s what you would walk away with in your pocket if you paid everyone off and sold everything you owned. I don’t include things like clothing or furniture, for example, as those are not considered assets.

Continuously tracking net worth is important when trying to understand where you are on the path to your goals — and whether it's time to recalibrate any of your investments. It ensures your wealth is moving in the right direction. And if it’s not, you’ll see it.

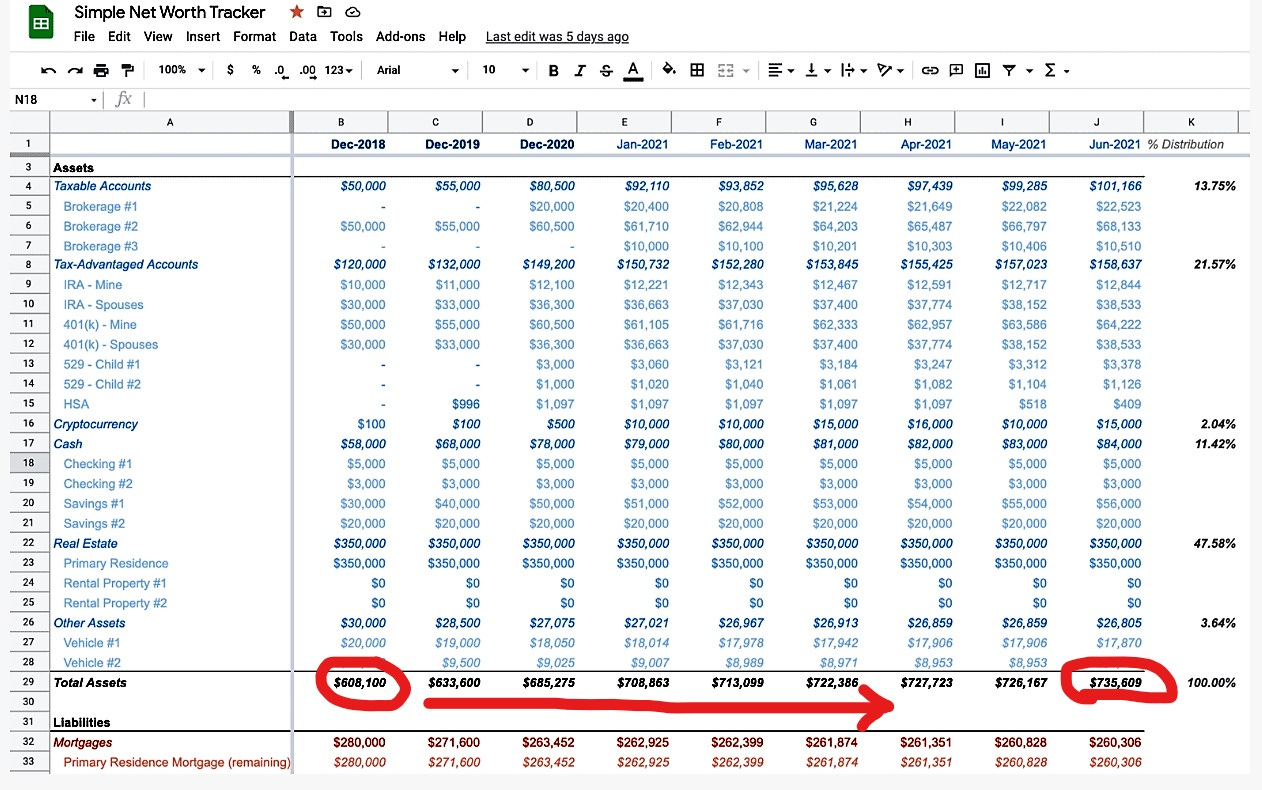

Calculating your net worth is easy to do and can be fun if you’re a money nerd like me. I created an excel spreadsheet years ago and started tracking my growth. It looks similar to the spreadsheet below.

At the bottom you can see the growth of assets from low $600K to almost mid $700K in three years.

This is just an example but you can actually quantify your progress…or lack thereof, in some cases.

If you’re interested in tracking your net worth, hit me up. I don’t yet charge for this!

When I started tracking my net worth, I could project out into the future and forecast where I would be in 6 months and 6 years, for example. Huge.

It’s a starting point.

Whatever your net worth…wherever you are is your starting point. It’s never too late to build wealth at any age. If your net worth is $12,000, then every $200 saved per month, for example, is a 20% annual growth rate in your net worth.

Think snowball.

Mindset

To achieve what 1% of the world’s population has, you must be willing to do what only 1% dare to do…hard work and perseverance of the highest order. —Manoj Arora

There is a mindset around money that is required to be successful, in my opinion. It’s bigger than what I could write about here in The Tobin Report. However, it’s a process that takes time.

If you want to adjust your mindset around money, I HIGHLY recommend reading Robert Kiyosaki’s “Rich Dad Poor Dad”. This was a game changer for me. It’s a great starting point at examining where you stand today and how you view money.

This book will help get your mind right regarding the VALUE and purpose of money and its relationship to your future. The overall theme is how to use money as a tool for wealth development and to learn to allow your money to work for you…as opposed to the other way around.

From this book, there are several lessons that stood out:

The financially free don’t work for money

Financial literacy is common for the financially free

To get there quicker, own a business

Understand taxes

Do not aim for more income, aim for more assets (that pay you)

Pay yourself first

Reinvest excess cash (more assets)

There is much more that what I can write here so just read the book if you haven’t!💥💥

Lastly, if you’re following along and looking to get better with your finances, start with assessing your current financial situation.

What is your net worth?

By understanding what assets you own, what liabilities you owe, you have a birds eye view of where to start.

Let’s gooooooo!!

Thanks for reading everyone. Time to watch Game 3 of the Dodgers vs Padres in Game 3 of the NLDS!

Let’s Go Dodgers! ⚾⚾⚾⚾

Photo from a few weeks ago…not tonight’s game! I wish!

On deck for next week’s Tobin Report: