Quick Hits: Options Expiration, Housing, Jobs, Energy, Trade Ideas

Just a few things on my mind to share this morning, including market manipulation and some trade ideas

Good morning all,

New to The Tobin Report? Welcome. We are all about money, markets, & charts!

Subscribe for free if you haven’t already. Consider a $10 paid subscription for more in depth ideas, trades, videos and portfolio suggestions.

A few quick hits…let’s get to work…

📅 Options Expiration

Today is options expiration for the month of April. I am acutely aware of these days. Markets get funky a couple days leading up to it…and manipulation is at it’s peak. This is usually ‘sell off’ time.

If you know it…and expect it…then it’s no surprise when your account is red on days like today.

This is known as "pinning”, which occurs when the price of a stock is held near a specific strike price that has a large number of open options contracts. Market makers who have sold these options contracts manipulate price to maximize their profits buying or selling the underlying asset to keep the price near the strike price.

Watch how prices close on options expiration. Many will close within a penny or two off a round number price….$23.99, $63.01, $149.98, for example.

Crazy.

So yes, markets are manipulated.

🏡 HOUSING

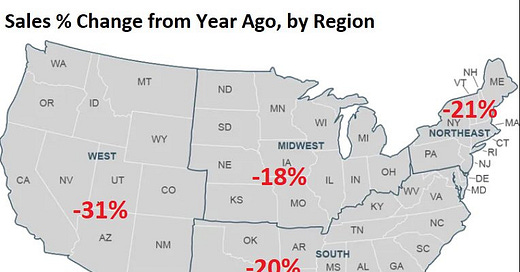

Is anyone moving anymore?

Home sales in March fell 21% year-over-year. Many homeowners have super low mortgages and have no incentive to sell. Many looking for homes aren’t willing to buy with mortgages at current levels whilst (cool word!) home values are still elevated.

🏘️ On a monthly basis, sales of existing homes in the US fell more than expected in March, dropping 2.4%.

It was the 13th decline in sales in the last 14 months.

The median selling price for those homes fell by 0.9% from a year earlier to $375,000, marking the biggest drop since January 2012.

👷♀️ JOBS

Weekly initial jobless claims rose by 5,000 to 245,000—the highest since November 2021. The labor market continues to weaken slightly.

It was the 5th time in 7 weeks that initial claims have been above 240,000.

Recessions are historically marked by a 20% increase in claims from a year prior. Continuing claims rose to 22% above their levels from a year ago…recession?

🛢️ ENERGY

I wrote about oil yesterday and The Imminent Trade.

When prices leave a gap…those typically get filled, meaning price will come back to it at some point before potentially going higher.

Oil prices are sitting just above this gap level where OPEC+ shocked markets with surprise production cuts.

Recession fears are weighing on demand.

🎯 TRADES

Interested in receiving real time trade alerts via text message? Sign up below. Super quick/easy. 👇

Trade ideas:

Here are a list of charts I like for swing trades and intermediate term holds. These are bearish to bullish setups and showing a turn OR breakout and re-tests…all for LONG positions. Some are ready now…some need to cool off a bit and pullback before entering. You must look at the charts.

Please do you own due diligence as these are merely ideas.

AMZN

XRAY

SJW

PLTR

BGS

CME

CMCSA

INTC

There you have it for today. Items top of mind. Thanks for reading. Please share with a friend if you find these reports helpful.

Eric

Hi Eric, cocerning reciving text-messages: for subsribers outside USA it’s not an option. Have you thought about alternatives (Discord/Telegram.... )?